Accounting Reports En

2.5 Налаштування компенсаційних виплат

Встановіть типовий компонент для наступних складових заробітної плати.

Для користувачів з Індії, налаштування типового значення в цьому розділі допоможе при розрахунках декларації податків працівника, зокрема для визначення суми звільнення від податку HRA.

- Основний компонент

- Компонент HRA

- Компонент заборгованості

2.6 Консолідовані фінансові звіти

Перейдіть до: Рахунки > Бухгалтерські звіти > Консолідований фінансовий звіт.

Звіт відображає консолідований перегляд Балансу, Звіту про прибутки та збитки та Руху грошових коштів для групової компанії, об’єднуючи фінансові звіти всіх дочірніх компаній. Він показує баланси для кожної окремої компанії та сумарні баланси для групової компанії.

2.7 Financial Ratios Report

Introduction

A financial ratio is a measurement tool used to evaluate a company’s financial condition or performance relative to other businesses. This tool is commonly used by investors to study and obtain insight about a company’s financial history or the overall industry. The process of computing a financial ratio involves extracting numbers from the balance sheet, income statement, and cash flow statement. Rather than just being a calculation, a financial ratio offers an understanding of a company’s economic status in areas such as profitability, liquidity, leverage, and market valuation. A ratio can act as a signal, alert, or hint towards various potential issues.

Assumptions

-

Net Sales = Direct Income

-

Credit Sales = Direct Income

-

Credit Purchases = Direct Expense

-

Share Holder Fund (SHF) = Total Asset - Total_Liability

-

Net Profit After Income & Taxes(NPAIT) = Total Income - Total Expense

Types of Ratios:

2.7.1 Liquidity Ratios

Consists of:

2.7.1.1 Current Ratio = Current Assets/Current Liability

2.7.1.2 Quick Ratio = Quick Assets/Quick Liability

Requires 2 types of accounts:

-

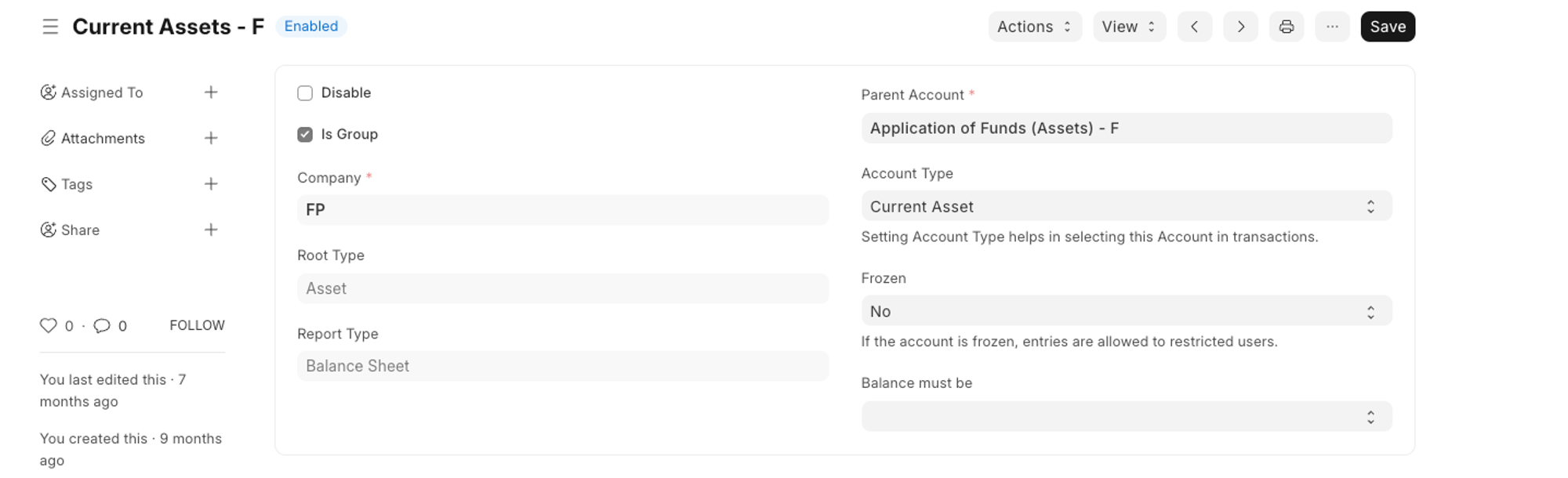

Current Asset(e.g)

-

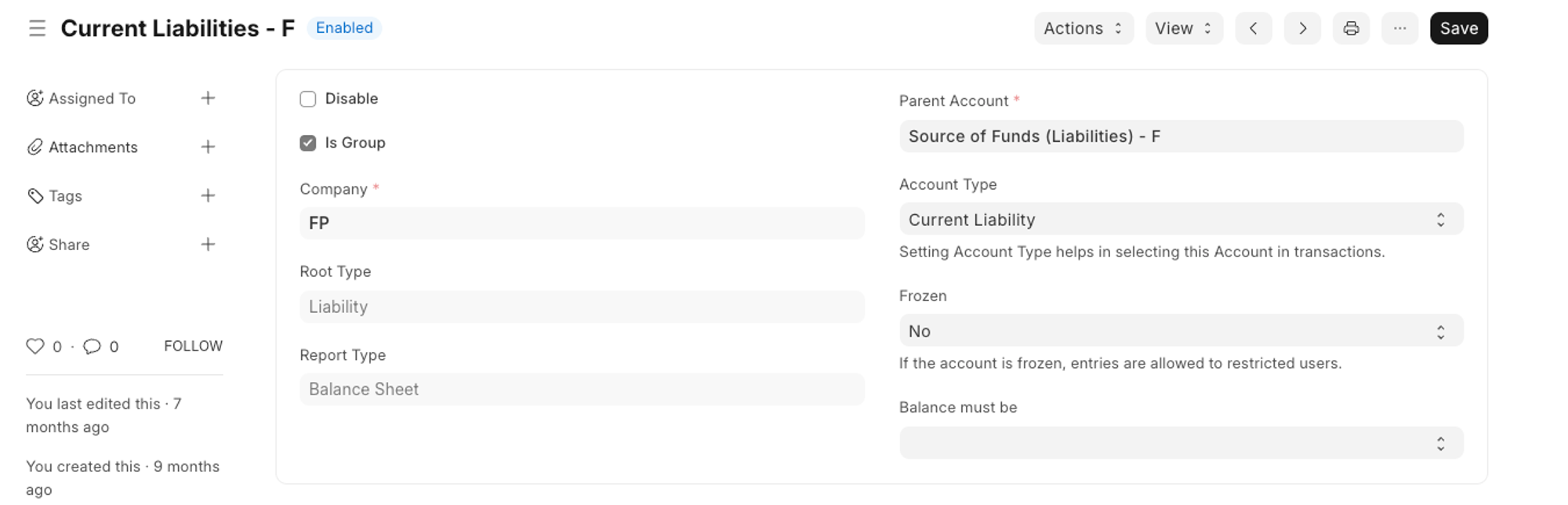

Current Liability(e.g)

As soon as you will set your account types for the relevant account in your “Chart of Accounts”, both Current Ratio and Quick Ratio will show the correct value.

2.7.2 Debt Equity Ratios

Consists of:

2.7.2.1 Debt Equity Ratio = Total Liability / SHF

2.7.2.2 Gross Profit Ratio = (Net Sales - COGS)/Net Sales

2.7.2.3 Net Profit Ratio = NPAIT /Net Sales

2.7.2.4 Return on Asset Ratio = NPAIT/Total Assets

2.7.2.5 Return on Equity Ratio = NPAIT/SHF

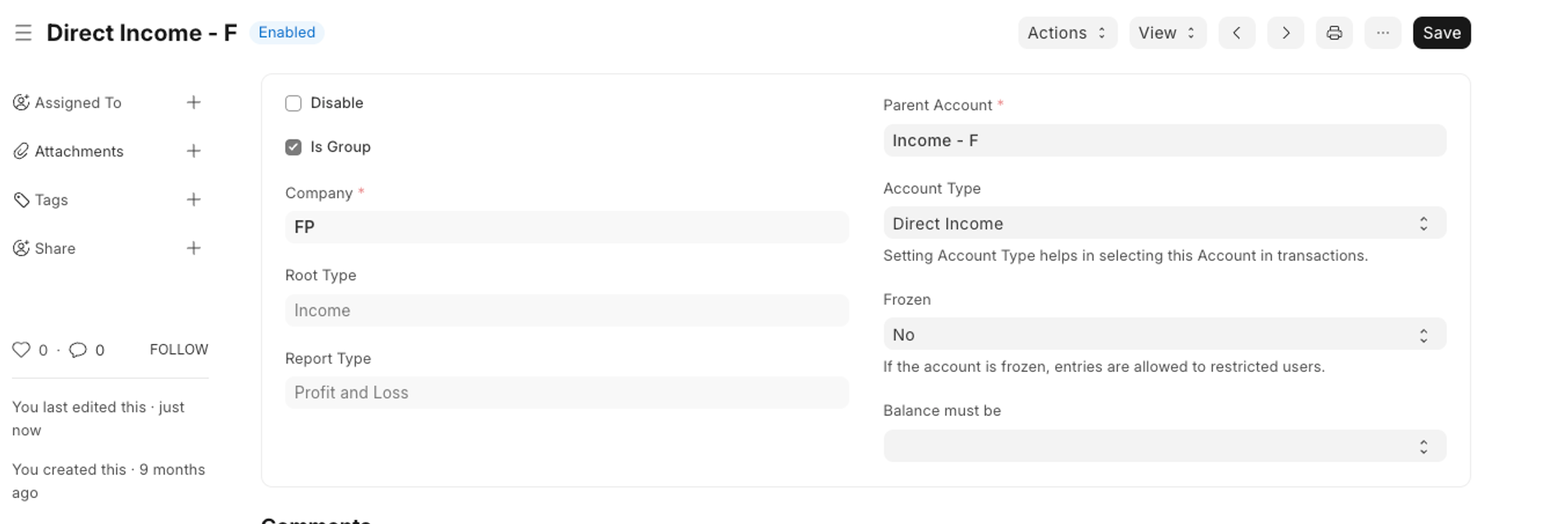

For Gross Profit Ratio and Net Profit Ratio to show the correct data we need to add the relevant account type to “Direct Income” (as direct income is treated as Net Sales). (e.g.)

2.7.3 Turnover Ratios

Consists of:

2.7.3.1 Fixed Asset Turnover Ratio = COGS/ Avg. Stock

2.7.3.2 Debtor Turnover Ratio = Credit Sales / Avg. Debtors

2.7.3.3 Creditor Turnover Ratio = Credit Purchases / Avg. Purchases

2.7.3.4 Inventory Turnover Ratio = Net Sales / Total Assets

Average of Stock / Debtors / Purchases is calculated by ⇒

(opening of first year + closing of last year) / 2

3. Taxes

3.1 Sales and Purchase Register

Go to: Accounts > Taxes > Sales Register or Purchase Register.

The Sales and Purchase Register report shows all the Sales and Purchase transactions for a given period with invoiced amount and tax details. In this report, each taxes has a separate column, so you can easily get total taxes collected / paid for a period for each individual tax type, which helps to pay the taxes to government.

4. Budget and Cost Center

4.1 Budget Variance

Go to: Accounts > Budget and Cost Center > Budget Variance Report.

In ERPNext, you can assign expense budget for an expense account against any specific cost center. This report gives a comparison between budgeted and actual expenses and the variance (the difference between the two) in monthly / quarterly / yearly view.

5. Analytics

5.1 Item wise Sales and Purchase Register

Go to: Accounts > Analytics > Item-wise Sales Register or Item-wise Purchase Register.

The Item Wise Sales and Purchase Register report shows all the Sales and Purchase transactions for a given period with item rate, quantity, amount and tax details. In this report, taxes has a separate column, so you can easily get individual taxes for each individual item. From this report you can have a look of which items are sold or purchase most.

More detailed analysis can also be done by using the ‘Group By’ filter which gives sales data for a specific Customer, Supplier, Territory, etc. You can find out which Item is more popular in which region or which Customer is buying which Item more.

5.2 Sales or Purchase Invoice Trends

Go to: Accounts > Analytics > Sales Invoice Trends or Purchase Invoice Trends.

Another very useful report is invoice trends, From this report you can easily get the trending items on monthly, quaterly, half yearly or yearly basis. You will get the idea of sales and purchase both in quantity and amount.

6. To Bill

-

Ordered Items To Be Billed: The report shows the items which has been ordered by customers, against which Sales Invoice has not been created / partially been created.

-

Delivered Items To Be Billed: The items which has been delivered to the customers, but Sales Invoice has not been created / partially been created.

-

Purchase Order Items To Be Billed: The report shows the items which has been ordered from the suppliers, but Purchase Invoice has not been created / partially been created.

-

Received Items To Be Billed: The items which has been received from the suppliers, but Purchase Invoice has not been created / partially been created.

7. Other Reports

7.1 Party Wise Trial Balance

Go to: Accounts > Other Reports > Trial Balance for Party. Usually you might need to see the trial balance for your customesrs and suppliers. You can easily get for all of your customers or suppliers and also for individual.

7.2 Customer Credit Balance

The report shows the credit limit, outstanding and credit balance for each customer.